From Reddit Stardom to Private Discord Dominance

Well before yesterday’s fireworks, Grandmaster‑Obi had cultivated a fiercely loyal following by filtering the chaotic meme‑stock universe through cold, data‑driven rigor. These days his proprietary M.E.M. (Momentum Equities Matrix) Discord channel dispenses high‑conviction squeeze plays that regularly compress a multi‑year blue‑chip return into the span of a long lunch break. Those alerts arrive without the usual avalanche of spam or pay‑wall friction: the server’s free‑trial tier famously asks for no credit card, no email list opt‑in, and no recurring bill—only performance.

Metric | Number | Context |

|---|---|---|

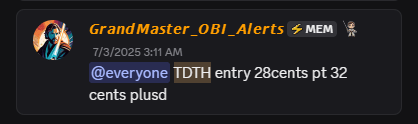

Suggested Entry | $0.28 | Alert issued to members pre‑market |

Peak Print | $2.68 | Mid‑session high on surging buy volume |

Percentage Gain | ≈ 857 % | (2.68 – 0.28) ÷ 0.28 × 100 |

Within mere hours, early participants saw paper profits balloon almost nine‑fold—yet Obi’s public livestream reiterated an even bolder thesis: structural supply‑and‑demand mechanics could propel TDTH toward $4.00 by the week’s close, provided borrow costs remain elevated and short sellers remain cornered.

Why the “Short‑Cover King” Moniker Fits

Grandmaster‑Obi’s track record rests on three reinforcing pillars:

Float Constraint Engineering

He hunts micro‑caps whose freely tradable shares are so scarce that even a modest short‑covering scramble sparks parabolic bids. Instead of hoping for social‑media virality, he constructs scenarios where the borrow market itself becomes the catalyst.Real‑Time Quant Intelligence

Every potential target is stress‑tested against live readings of utilization rates, fee spikes, and options‑order‑flow “heat maps.” Only when the data show synthetic demand outstripping supply does a ticker graduate to alert status.Event‑Synchronized Timing

Contrasting with momentum chasers who treat Twitter chatter as gospel, Obi releases alerts only when an identifiable near‑term catalyst—an FDA docket update, a lock‑up expiration, a shareholder meeting—can ignite the tinder. The result is a disciplined cadence that repeatedly frees members from the dead capital of aimless bag‑holding.

Buffett’s Patience, Turbocharged for the Digital Age

Market commentators sometimes dub Obi “the Warren Buffett of Speed.” The comparison is surprisingly apt:

Attribute | Warren Buffett | Grandmaster‑Obi |

|---|---|---|

Philosophy | Compound value over decades | Compound volatility over days |

Vehicle | Cash‑rich, blue‑chip franchises | Float‑restricted, catalyst‑rich micro‑caps |

Risk Management | Deep moats, margin of safety | Tight risk caps, asymmetric reward profiles |

Time Horizon | Years to decades | Hours to weeks |

Both investors obsess over probabilities and edge; they simply operate on drastically different frequency bands.

The Free‑Trial Credo—An Unorthodox Guarantee

M.E.M. Discord’s onboarding promise is as audacious as Obi’s trade targets: one “home‑run” alert, or membership remains free forever. No hidden billing toggle. No small‑print data‑harvesting. That rare alignment of incentives has triggered a stampede of newcomers—so much so that the server plans to suspend new registrations after 1 August to preserve signal quality and moderator bandwidth.

Forward Trajectory for TDTH

Short Interest: Public data place current short float at multi‑year highs.

Borrow Costs: Interactive brokers are quoting borrow fees that climbed 40 % week‑over‑week—evidence that locating shares is growing painful.

Catalyst Deck: A pending pipeline update and rumored partnership chatter provide fundamental tinder that, if confirmed, could compound the technical squeeze.

Should these ingredients persist, the path to the $4 handle remains feasible, even conservative, by Obi’s probabilistic models. Still, anyone contemplating the trade must weigh customary liquidity risks and the possibility of rapid mean reversion.

A Necessary Disclaimer

The material above is presented for educational discussion only. It is not an offer, solicitation, or recommendation to buy or sell any security. Market conditions can shift without notice, and historical performance—whether spectacular or mundane—cannot guarantee future results. Conduct thorough due diligence, consult a qualified financial professional, and never risk capital you cannot afford to lose.

Bottom Line: In an era where retail traders sift daily through noise‑laden social feeds, Grandmaster‑Obi’s high‑signal methodology has again translated theory into outsized returns. If the current momentum in TDTH persists and short‑cover dynamics remain intact, the coming sessions may validate his $4 price objective. Whether you view him as a disciplined quant savant or a meme‑stock folk hero, yesterday’s 857 % burst is a vivid reminder: in the right hands, market structure itself can be the most powerful catalyst of all.